The hybrid car sales doubled in H1 2025 across India, reflecting an unmistakable shift in consumer preferences and the country’s automotive landscape. As buyers weigh long-term cost, practicality, and sustainability, the debate has intensified: Should India continue embracing hybrids as a stepping stone or leap straight into all-electric mobility? Here’s a data-driven breakdown of hybrid and EV market growth, infrastructure challenges, and what automakers, policymakers, and buyers should consider in 2025.

Also Read: Top 5 Fuel Efficient Petrol Compact SUVs in India

Hybrid Car Sales Doubled in H1 2025 – By The Numbers

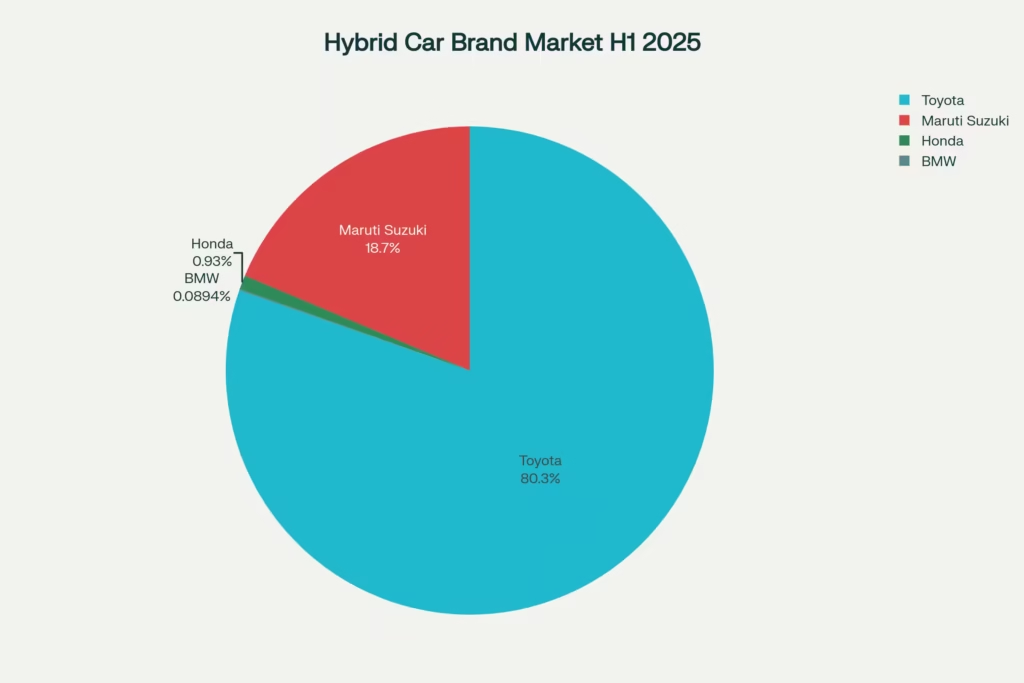

The first half of 2025 has been pivotal. Hybrid car sales doubled in H1 2025, with over 52,000 units sold nationwide between January and June—a 100%+ growth compared to the same period last year. Toyota Kirloskar Motor dominates the market, contributing more than 80% of all hybrid sales, driven primarily by models like the Urban Cruiser Hyryder and Innova Hycross. Maruti Suzuki and Honda are also posting triple-digit growth percentages for their hybrid offerings.

| Manufacturer | Hybrid Vehicles Sold H1 2025 | Market Share (%) |

|---|---|---|

| Toyota | 42,242 | 80+ |

| Maruti Suzuki | 9,809 | ~18 |

| Honda | 489 | ~1 |

| BMW | 47 | <1 |

This is a massive surge compared to the limited portfolio and modest figures seen just two years prior, showing the hybrid’s growing acceptance in India’s mass and premium segments.

Why Are Hybrid Car Sales Doubling in 2025?

- Fuel Efficiency: Strong-hybrid powertrains offer 40–60% better mileage over regular petrols in city traffic—a decisive factor as fuel prices remain high.

- Range Anxiety Relief: Hybrids resolve range and charging fears that come with EV adoption, especially in areas where charging infrastructure is lacking.

- Government & State Incentives: States like Uttar Pradesh now waiver registration fees for hybrids.

- Emissions Compliance: Tighter emission standards are prompting more automakers to roll out hybrid powertrains as an easy upgrade to meet future norms.

EV Growth is Strong, But Is Infrastructure Ready?

While hybrid car sales doubled in H1 2025, electric car sales also soared by 53% to over 74,000 units, indicating strong momentum. However, there’s a crucial caveat:

- Charging Infrastructure: India had more than 29,000 operational public EV charging stations by May 2025, with aggressive plans for 72,000 by 2026.

- Gaps Remain: Major cities dominate charging locations, while tier-2/3 cities and highways lag behind. Reliability and station uptime still need major improvements, and only about 3–4% of new car buyers actually purchase EVs, citing charging as a key barrier.

- Consumer Hesitation: Most Indian buyers want confidence in daily convenience—which hybrids provide by not depending on external charging.

Also Read: Top 5 Automatic Cars in India Under 15L

Hybrids vs EVs in India 2025

| Factor | Hybrid Cars | Electric Cars (EVs) |

|---|---|---|

| Main Benefit | No range anxiety, instant refueling | Zero tailpipe emissions |

| Refueling/Charging | Petrol stations everywhere | 29,000+ public chargers, growing |

| City Mileage (km/l or kWh) | 23–27 km/l (hybrids, real-world) | 6.5–8 km/kWh (EVs, variable) |

| Government Taxes/Levy | 43% GST (no FAME-II), some state waiver | 5% GST, FAME-II + local perks |

| Upfront Price Gap | Slightly costlier than petrol/diesel | Significant battery premium |

| Main Drawback | Limited low-cost models, less support | High initial cost, infra gaps |

| 2025 Sales (Jan–Jun) | 52,587 | 74,653 |

Do We Need Hybrids in India or Switch Directly to EVs?

Why Hybrids?

- Seamless Transition: Hybrids are a proven, accessible way for buyers new to electrification to adapt without radical changes in daily routine.

- Better for Rural/Highway Use: Unlike EVs, hybrids are well-suited for long drives and areas with minimal charging.

- Lower Running Costs vs Petrol: Noticeably better than regular ICE cars without the full EV price tag.

Also Read: Tata Harrier EV vs Hyundai Creta Electric

Why Not Just EVs?

- Charging Hurdles: Even with 29,000+ chargers, urban concentration and reliability issues leave many potential buyers unconvinced.

- Purchase Cost: Battery tech remains expensive, and mass-market EVs (with useful range) are still pricier than their petrol or hybrid counterparts.

- Limited Model Options: Despite growth, most EVs are in premium or niche segments; hybrid portfolios, especially from Toyota and Maruti, are expanding faster in affordable space.

Consumer Sentiment

Recent surveys suggest only 8% of Indian consumers express intent to buy a pure EV as their next car, compared to higher intent for hybrids or plug-in hybrid electric vehicles (PHEVs), primarily due to infrastructure concerns and cost barriers.

Also Read: Tesla Model Y Debuts in India at ₹59.9 Lakh – 622 Km Range & Autopilot

Market Outlook – What’s Next for Hybrid and EVs in India?

Automakers previously dismissive of hybrids are now investing significantly, with several planning hybrid launches over the next two years. Meanwhile, BEV models will increase as government and industry work together to close the infrastructure gap.

Key Takeaways – Hybrid Car Sales Doubled in H1 2025

- The hybrid car sales doubled in H1 2025, driven by consumer demand for convenience, fuel economy, and reliability.

- EV growth is robust, but limited by the pace and distribution of charging networks.

- For most Indian buyers in 2025, hybrids remain the practical, immediately available middle ground between old-school petrol/diesel and the all-electric future.

- Policy changes (tax parity, expanded perks) could accelerate hybrid penetration even further.

The hybrid car sales doubled in H1 2025 sends a clear message: until charging is truly ubiquitous and reliable, hybrids are not just a stepping stone—they’re a necessary and smart choice for India’s present mobility needs.