The July 2025 car sales report reveals a dynamic landscape for India’s auto industry. While segment leaders like Maruti Suzuki continue to command massive volumes, brands like Hyundai and Mahindra jostle closely for the second spot, and Kia and MG post robust growth on the back of popular SUV and EV models. Tata Motors remains a reference point for electrification momentum, while Toyota maintains a steady climb with strong hybrid performances. Let’s break down the numbers, growth, and trends for each manufacturer.

Also Read: Top 10 Best Selling Cars in July 2025

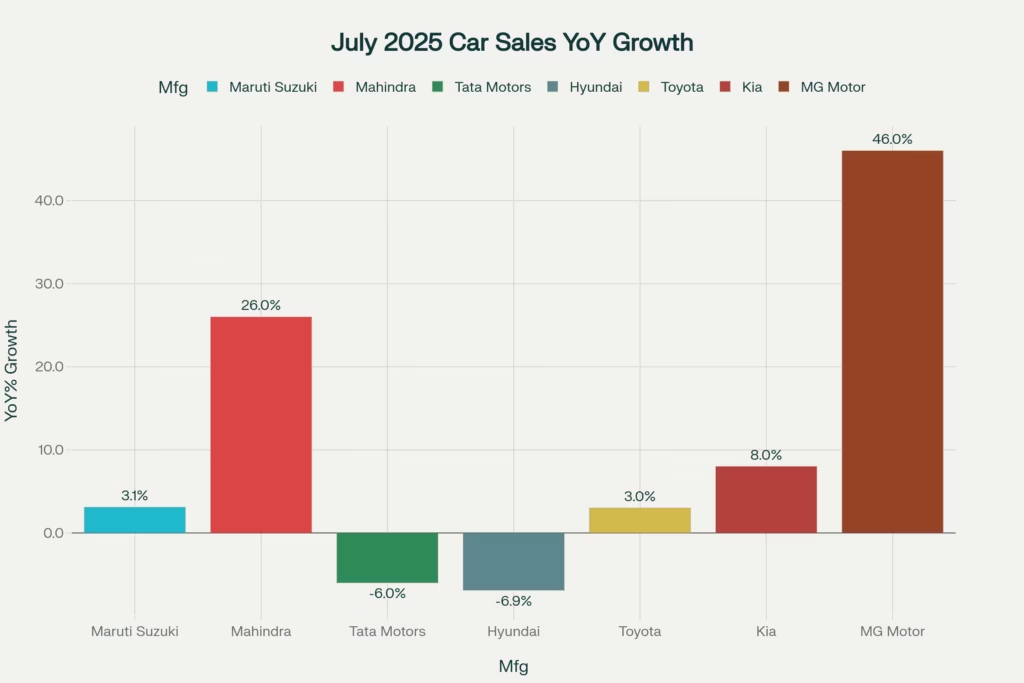

July 2025 Car Sales Report: Brand-wise Volume & Growth

| Manufacturer | July 2025 Sales | YoY Growth (%) | Notable Trends / Comments |

|---|---|---|---|

| Maruti Suzuki | 180,526 | +3.1 | Exports boost, UVs struggle vs. 2024 |

| Mahindra | 83,691 | +26 | SUV surge (49,871 units), new XUV 3XO drive growth |

| Tata Motors | 69,131 | -6 | ICE down, record-high EV sales (+42%) |

| Hyundai | 60,073 | -6.9 | SUVs now 71.8% of sales, Creta hits record |

| Toyota | 32,575 | +3 | Consistent, led by Hyryder and hybrids |

| Kia | 22,135 | +7.94 / +8 | Seltos, Carens, new Clavis, and EVs boost sales |

| MG Motor | 6,678 | +46 | Best-ever month, ZS EV, Comet, luxury launches |

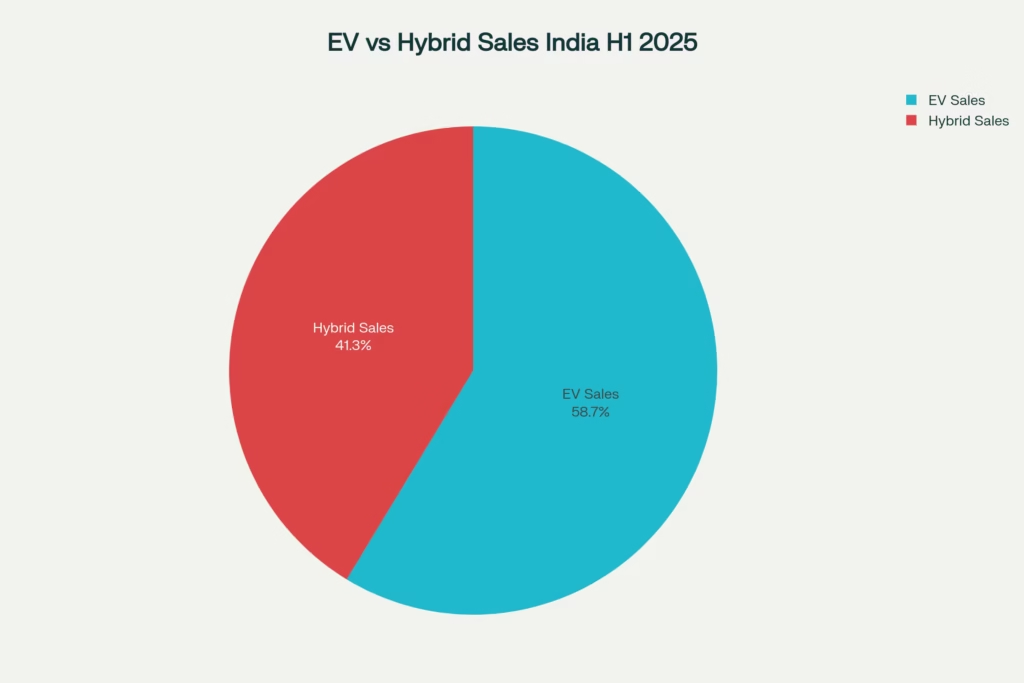

Also Read: Hybrid Car Sales Doubled in H1 2025 – Better Than EVs for India’s Roads?

Key Brand Performances

Maruti Suzuki: Market Leader With Marginal Growth

- Total sales: 180,526 units (+3.1% YoY).

- Domestic PV sales: 137,776; exports: 31,745 (+33%).

- Best-sellers: Swift, WagonR, Dzire, Ertiga, Brezza, FRONX. Mini-car segment struggled; UV sales dipped from 56,302 (2024) to 52,773 (2025).

- Trend: Maruti strengthens export focus, but faces headwinds in entry and UV segments

Also Read: Top 5 Fuel Efficient Petrol Compact SUVs in India (2025)

Mahindra: Surging Ahead With SUVs

- Total sales: 83,691 units (+26% YoY).

- SUVs: 49,871 sold domestically (+20%), total UV sales including exports are 50,835.

- Segment highlights: Scorpio-N, Thar, XUV700 boosted momentum; new XUV 3XO ‘REVX’ series contributed to growth.

- Commercial vehicles: Steady; 21,571 LCVs sold.

- Electric and new models: Delivery for BE 6 & XEV 9E has started, reflecting broadening portfolio

Tata Motors: ICE Down, EVs Hit New Peak

- Total sales: 69,131 units (down by 6% YoY).

- Passenger vehicles: 40,175 (PV; -11%), domestic PV 39,521; overseas up 186% to 654.

- Electric Vehicles: 7,124 units (+42% YoY), record monthly EV sales.

- Commercial vehicles: 28,956 (+7% YoY).

- Trend: Demand softening in ICE PVs, but Tata dominates the growing EV segment with Nexon.ev, Punch.ev, Harrier.ev

Hyundai – SUV Share at All-Time High, Flat Sales

- Total sales: 60,073 (-6.9% YoY)

- Domestic: 43,973; Exports: 16,100

- SUV Share: SUVs accounted for 71.8% of domestic sales—the highest ever, largely on Creta’s 10-year reign.

- Highlights: Creta remains India’s best-selling mid-size SUV, crossing 1.2 million units since 2015. Despite the decline, Hyundai’s SUV portfolio is stronger than ever.

Toyota: Steady Gains and Hybrid Strength

- Total sales:32,575 units (+3% YoY)

- Domestic: 29,159

- Exports: 3,416

- Cumulative Jan–July: 207,460 units (+14.04% YoY)

- Highlights: Urban Cruiser Hyryder, Glanza, and newer hybrids are growth drivers. Toyota’s Maruti collaboration continues to provide access to new customers and segments.

- Trend: Hybrids retain attraction as buyers embrace low running costs and government incentives

Kia – Strongest Ever July, SUV & EV Push

- Total sales: 22,135 (+7.94%/+8% YoY)

- Exports: 2,590 (July 2025)

- Highlights: Seltos leads the pack, with strong numbers from Carens and the just-launched Clavis and Clavis EV. Consistent YoY, MoM, and YTD growth boost Kia’s brand momentum.

MG Motor: Breaks Records with Diversified Lineup

- Total sales: 6,678 units (+46% YoY), highest monthly in 2025.

- Best-sellers: ZS EV, Comet, Astor, and launch of luxury MG Select range (M9 Presidential Limousine, Cyberster).

- Trend: Electrified & tech-forward strategy resonates with upwardly mobile buyers; MG broadening portfolio with unique offerings

Also Read: Volkswagen Taigun Facelift Set for 2026 – Exciting Upgrades & Spy Shots

July 2025 Car Sales Report – Brand-wise Growth Comparison

| Manufacturer | July 2025 Sales | July 2024 Sales | Growth (%) |

|---|---|---|---|

| Maruti Suzuki | 180,526 | 175,041 | +3.1 |

| Mahindra | 83,691 | ~66,442 | +26 |

| Tata Motors | 69,131 | 71,996 | -6 |

| Hyundai | 60,073 | 64,563 | -6.9 |

| Toyota | 32,575 | 31,656 | +3 |

| Kia | 22,135 | 20,507 | +8 |

| MG Motor | 6,678 | 4,575 | +46 |

Insights & Industry Impact

- SUVs continue to dominate Indian buyers’ wishlist. Mahindra and Tata, followed by Maruti and Hyundai, remain key players in this space.

- Electrification gains pace: Tata Motors posts highest-ever monthly EV sales—EV share inches closer to 18% of Tata’s PV sales.

- Hybrids see growing traction: Toyota and Maruti benefit from expanded hybrid portfolios and improved state incentives.

- MG sets the pace in affordable and luxury EVs. Tech focus and continuous launches are driving new records.

- Exports cushion slowdowns: Maruti Suzuki and Tata use global market access to offset domestic softness.

- Month’s surprise: Tata’s overall sales dip, despite EV momentum, signals fierce competition and changing buyer dynamics.

- New Entrants & Segment Shifts: Kia’s Clavis/EV launch, MG’s luxury focus, and Mahindra’s expanding EV portfolio keep competition fierce.

Other Brands & Outlook

- Volkswagen, Skoda, Renault, Honda and others continue to chase share but trail behind the top five.

- Commercial Vehicles and 3-Wheelers: Mahindra and Tata’s strong CV & 3W figures highlight demand for freight and urban mobility.

The Road Ahead

The July 2025 car sales report makes one trend clear—India’s market is more dynamic than ever, with electrification, hybrid tech, and SUVs driving the conversation. The month’s results affirm the market’s resilience and showcase shifting preferences toward smarter, greener, and more versatile vehicles. Expect further action in EV and hybrid segments as new launches arrive in the festive season.