The electric car sales in July 2025 paint an impressive picture of India’s ongoing e-mobility revolution. With a record 15,423 electric passenger vehicles sold, July 2025 marks a historic month—registering 93% year-on-year growth and standing as the highest EV sales tally for any month this calendar year. Backed by new model launches, intense brand competition, and rising consumer awareness, India’s EV market is now one of the fastest growing globally.

Also Read: Is an EV Car Good for Long Drive? A 2025 Guide

Electric Car Sales in July 2025 by Brand

| Brand | July 2025 Sales | Market Share (%) | Key Models | YoY Growth (%) |

|---|---|---|---|---|

| Tata Motors | 6,019 | 38 | Nexon EV, Punch EV, Harrier EV | 18 |

| MG (JSW MG Motor) | 5,061 | 32 | Windsor, Comet, ZS EV, M9 MPV | 200+ |

| Mahindra | 2,810 | 17 | BE 6, XEV 9e | 225 |

| Hyundai | 610 | 5 | Creta Electric, Ioniq 5 | — |

| BYD | 457 | 2 | Atto 3, Seal, Sealion 7, eMax 7 | — |

| Kia | 57 | ~0.4 | Carens Clavis EV, EV6 | — |

| Citroen | 41 | ~0.3 | e-C3 | – |

| Luxury Segment | 408 | 3 | BMW, Mercedes, Volvo, Porsche, RR | 64 |

| Total | 15,423 | 100 | 93 |

Tata Motors: The Leader, but Competition Intensifies

Tata Motors continues to dominate electric car sales in July 2025, crossing the 6,000-unit mark for the first time in eight months. With a 38% market share, Tata stays at the top, though its leadership is now more closely challenged. Its broad, mass-market EV lineup—Nexon EV, Punch EV, Harrier EV—caters to varied price and segment demands. Tata’s annual goal: recapture 50% EV market share and reinforce its first-mover advantage.

Key Insights:

- Tata’s 6,019 sales in July represent 18% YoY growth, even as its share drops from 67% to 38% due to intense rivalry.

- The company is investing ₹35,000 crore over five years to expand and upgrade its EV offerings.

Also Read: Tata Electric Cars Loyalty Discount – Save Up to ₹1 Lakh

MG : Windsor Drives Massive Growth

MG is rapidly emerging as the biggest threat to Tata’s regime in electric car sales in July 2025. Registering 5,061 units, MG nearly doubles its market share versus last year—now standing at 32%. The Windsor hatch remains the bestselling premium EV month after month, while new additions like the M9 MPV and Cyberster sports car are carving out a niche at the higher end.

Why MG is Winning:

- Strong urban demand and positive brand recall around the Windsor.

- Expansion into premium MPVs and sportscars helps build overall portfolio appeal, even as sales volume remains concentrated in the Windsor and Comet.

Mahindra: A Rising EV Force

Third-placed Mahindra recorded 2,810 EV sales in July, more than doubling its share compared to last year (now 17%). New mid-variant options for BE 6 and XEV 9e helped sustain momentum, and continued rollouts are expected to boost figures further next month.

Noteworthy:

- Though July numbers dipped vs. previous months, Mahindra’s 225% YoY growth signals growing consumer acceptance and stronger EV pipelines from legacy brands.

- The BE and XEV 9e lines, with new packs and trims, offer compelling choices in the mid and premium-SUV segment.

Hyundai, BYD, Kia, Citroen: Niche, but Growing

- Hyundai: Sold 610 units; strong with Creta Electric but still shy of 1,000 units/month.

- BYD: Delivered 457 cars, constrained by price positioning and import barriers.

- Kia: With 57 units (and the Clavis now on sale), Kia’s entry into mass-market EVs is recent but promising.

- Citroen: Sluggish at 41 units, as the e-C3 finds most buyers in fleet/commercial segments where pricing dominates.

Also Read: Tata Harrier EV vs Hyundai Creta Electric – The Best 2025 Electric SUV Comparison

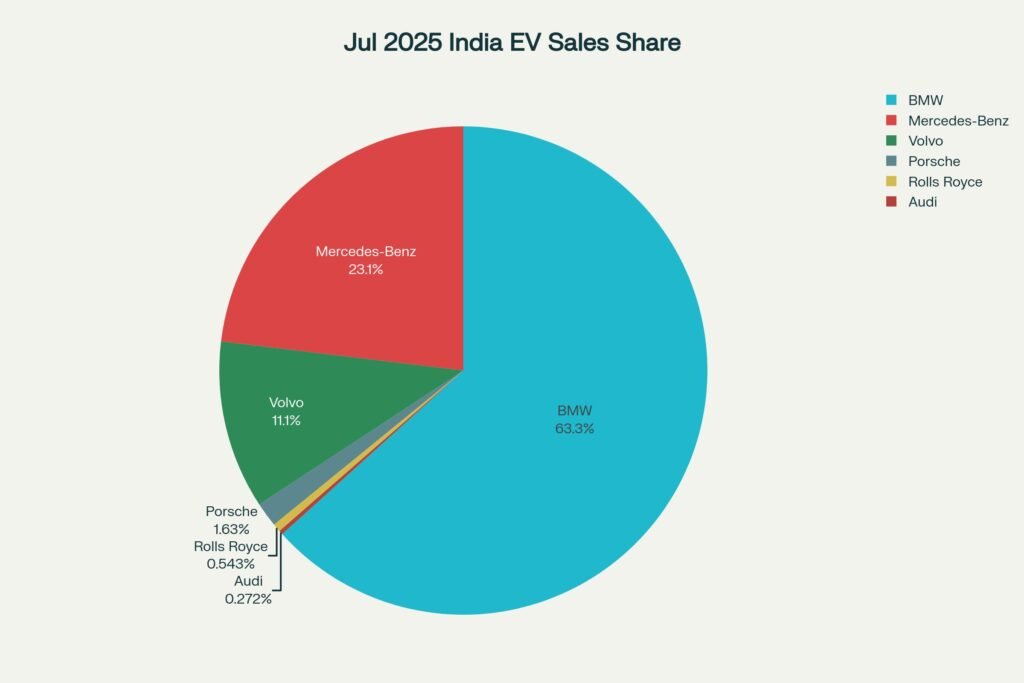

Luxury EV Segment: Continued Momentum

Luxury marques collectively notched 408 units in July (up 64% YoY), led by BMW (233 units) and Mercedes-Benz (85). Premium buyers are getting more EV choices, but volume remains heavily skewed to mass-market models.

Luxury EV Sales – July 2025

| Brand | Sales (July 2025) |

|---|---|

| BMW | 234 |

| Mercedes-Benz | 86 |

| Volvo | 41 |

| Porsche | 6 |

| Rolls Royce | 2 |

| Audi | 1 |

Key Market Trends for Electric Car Sales in July 2025

- Growth Across Segments: Total EV sales at 15,423 set a new high, with 93% YoY growth.

- Consolidation & Competition: Tata maintains leadership, but MG’s market share has doubled. Mahindra continues aggressive growth.

- Luxury Segment’s Rise: While holding only 3% volume, the luxury EV market is expanding, led by BMW and Mercedes.

- New Entrants: Kia and Citroen’s attempts suggest broadening scope, but success requires competitive pricing and dealer outreach.

- Consumer Shift: Increasingly, families and fleets move to EVs, driven by fuel savings, lower running costs, and improving infrastructure.

Also Read: Kia Carens EV HTK+ Review (2025)

The Road Ahead – What to Expect

As electric car sales in July 2025 highlight, India’s EV market is now deep and fiercely contested. The race for the top spot will intensify as Tata, MG, Mahindra, Hyundai, and others roll out fresh models, aggressively market, and invest in both technology and networks. With consumer choice at an all-time high, charging and policy support improving, and total cost of ownership tipping in EVs’ favor, expect even greater records and new entrants in the coming months.

For buyers and stakeholders, 2025 is shaping up to be a defining year in India’s EV revolution—one where variety, value, and volume promise to drive the market’s next phase.